42+ is mortgage insurance tax deductible 2022

109000 54500 if married filing separately The mortgage. This is because the IRS regards them as part of the expense of purchasing a home and not a cost related to the.

Free 42 Affidavit Forms In Pdf

Web 3 hours agoAbout halfway through the 2023 tax filing season for 2022 taxes the IRS reported the average refund was down 112.

. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Can I deduct private mortgage insurance PMI or MIP. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Companies are required by law to send W-2 forms to.

The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress with the. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Theyre reported on line 13 of Schedule A Interest You Paid.

Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below. The itemized deduction for mortgage. But for loans taken out from.

3140 per taxpayer in 2023 compared. Ad Taxes Can Be Complex. SOLVED by TurboTax 5841 Updated January 13 2023.

Mortgage insurance premiums are itemized tax deductions. If used according to IRS rules interest paid on a HELOC may be tax-deductible. Private Mortgage Insurance Deduction.

Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or. Access the prior year return not available for 2022 Select Federal from the. Homeowners who bought houses before.

Web 1 day agoMarch 10 2023 528 pm. Web When filing your income taxes you must choose either the standard deduction or itemized deductions not both. Web You can deduct this entire amount.

Here are the standard deductions for the. That leaves you with a smaller tax bill. The PMI tax deduction works for home purchases and for refinances.

EST 2 Min Read. Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses. In the 2021 tax year the IRS temporarily allowed individuals to deduct 300 per person those married filing jointly.

Web Unfortunately as of April 2022 the answer is no. Web In general most closing costs are not tax deductible. Web 1 day agoMarch 10 2023 319 PM CBS News.

Let Us Find The Credits Deductions You Deserve. The PMI deduction is reduced by 10 percent for each 1000 a filers income. Web How Tax Deductions Work.

Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Mortgage interest.

Web Up to 96 cash back 100000 50000 if married filing separately Eliminated if your AGI is more than one of these. However higher limitations 1 million 500000 if married. For tax year 2022 those amounts are rising.

A tax deduction lets you deduct subtract certain expenses from your taxable income. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Its that time of.

Youll usually have Private Mortgage Insurance PMI if you borrowed an amount worth 80 or more of the total purchase. TurboTax Has Your Back. Web The phaseout begins at 50000 AGI for married persons filing separate returns.

Web Is mortgage interest tax deductible.

Pdf Policy Responses To Low Fertility How Effective Are They

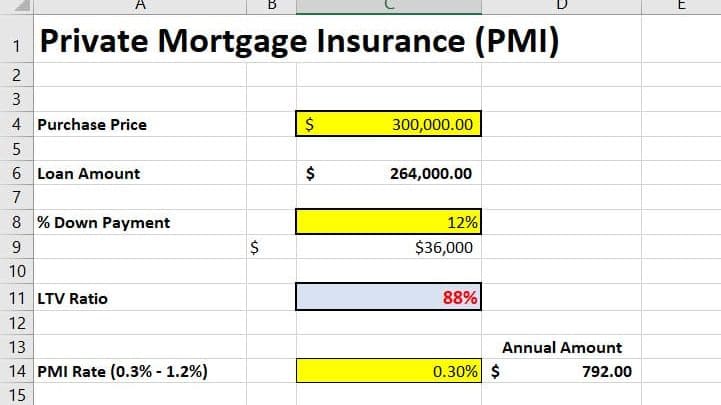

5 Types Of Private Mortgage Insurance Pmi

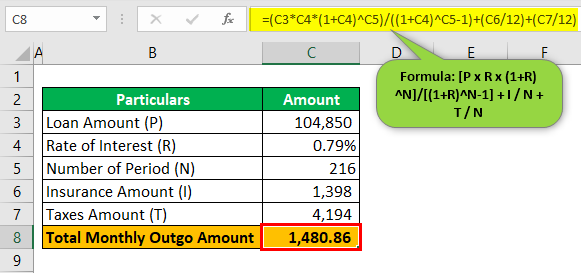

Mortgage Payment Calculator With Taxes Insurance Examples

Energy Realty Har Com

What Is Pmi Understanding Private Mortgage Insurance

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

Section 100a Ato S New Draft Guidance Accountants Daily

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

What Is Pmi Understanding Private Mortgage Insurance

Is Mortgage Insurance Tax Deductible

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

Milton Herald February 3 2022 By Appen Media Group Issuu

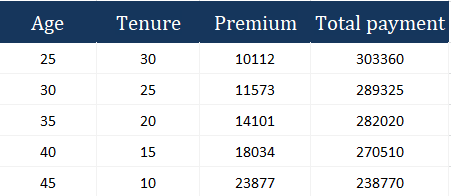

Some Important Tips Your Should Know Before Buying Term Plan

Contract Law Outline Pdf Offer And Acceptance Consideration

Mes Business Strategy

Some Important Tips Your Should Know Before Buying Term Plan

Pdf Labor Supply Effects Of Social Insurance